You may have heard that maintaining your discipline is a key aspect of trading. While this is true, how can you ensure you enforce that discipline when you are in a trade? One way to help is to have a trading strategy that you can stick to. If it is well-reasoned and back-tested, you can be confident that you are using a high-quality Forex trading strategy. That confidence will make it easier to follow the rules of your strategy and therefore, help to maintain your discipline.

A lot of the time when people talk about Forex trading strategies, they are talking about a specific trading method that is usually just one facet of a complete trading plan. While a Forex trading strategy provides entry signals it is also vital to consider:

- Position sizing

- Risk management

- How to exit a trade

Picking the Best Forex Strategy for You in 2020

When it comes to clarifying what the best and most profitable Forex trading strategy is, there really is no single answer. The best FX strategies will be suited to the individual. This means you need to consider your personality and work out the best Forex strategy to suit you. What may work very nicely for someone else may be a disaster for you.

Conversely, a strategy that has been discounted by others may turn out to be right for you. Therefore, experimentation may be required to discover the Forex trading strategies that work. It can also remove those that don't work for you. One of the key aspects to consider is a time-frame for your trading style.

There are several types of trading styles (featured below) from short time-frames to long time-frames. These styles have been widely used along the years and still remain a popular choice from the list of the best Forex trading strategies in 2020. The best Forex traders always remain aware of the different styles and strategies in their search for how to trade Forex successfully, so that they can choose the right one, based on the current market conditions.

- Scalping - These are very short-lived trades, possibly held just for just a few minutes. A scalper seeks to quickly beat the bid/offer spread, and skim just a few pips of profit before exiting and is considered one of the most advanced Forex trading strategies out there. This strategy typically uses low time-frame charts, such as the ones that can be found in the MetaTrader 4 Supreme Edition package. This trading platform also offers some of the best Forex indicators for scalping. The Forex-1 minute Trading Strategy can be considered an example of this trading style.

- Day trading - These are trades that are exited before the end of the day. This removes the chance of being adversely affected by large moves overnight. Day trading strategies are common among Forex trading strategies for beginners. Trades may last only a few hours, and price bars on charts might typically be set to one or two hours.

- Swing trading - Positions held for several days, whereby traders are aiming to profit from short-term price patterns. A swing trader might typically look at bars every half an hour or hour.

- Positional trading - Long-term trend following, seeking to maximise profit from major shifts in price. A long-term trader would typically look at the end of day charts. The best positional trading strategies require immense patience and discipline on the part of traders. It requires a good amount of knowledge regarding market fundamentals.

Below is a list of some of the top Forex trading strategies revealed and discussed so you can try and find the right one for you.

50-Pips a Day Forex Strategy

One of the latest Forex trading strategies to be used is the 50-pips a day Forex strategy which leverages the early market move of certain highly liquid currency pairs. The GBPUSD and EURUSD currency pairs are some of the best currencies to trade using this particular strategy. After the 7am GMT candlestick closes, traders place two positions or two opposite pending orders. When one of them gets activated by price movements, the other position is automatically cancelled.

The profit target is set at 50 pips, and the stop-loss order is placed anywhere between 5 and 10 pips above or below the 7am GMT candlestick, after its formation. This is implemented to manage risk. After these conditions are set, it is now up to the market to do the rest. Day trading and scalping are both short-term trading strategies. However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective risk management.

Below is a screenshot of the MetaTrader 4 trading platform provided by Admiral Markets Markets UK Ltd, showing the EURUSD H1 chart from the Zero.MT4 account:

Source:

Admiral Markets MetaTrader 4, EURUSD, H1 chart (between 26 May 2020 to

31 May 2020). Accessed: 31 May 2020 at 10:45 am BST - Please note: Past

performance is not a reliable indicator of future results or future

performance.

Source:

Admiral Markets MetaTrader 4, EURUSD, H1 chart (between 26 May 2020 to

31 May 2020). Accessed: 31 May 2020 at 10:45 am BST - Please note: Past

performance is not a reliable indicator of future results or future

performance.

The orange boxes show the 7am bar. In some instances, the next bar did not trade beyond the high or low of the previous bar resulting in no trading setup unless the trader left their orders in the market. The effectiveness of the trading has not been tested over time and merely serves at a platform of ideas for you to build upon. Past performance is not a reliable indicator of future results.

Did you know that you can learn to trade step-by-step with our brand

new educational course, Forex 101, featuring key insights from

professional industry experts? Click the banner below to register for

FREE!

Forex Daily Charts Strategy

The best Forex traders swear by daily charts over more short-term strategies. Compared to the Forex 1-hour trading strategy, or even those with lower time-frames, there is less market noise involved with daily charts. Such charts could give you over 100 pips a day due to their longer timeframe, which has the potential to result in some of the best Forex trades.

Daily trade signals can be more reliable than lower timeframes, and the potential for profit could also be greater, although there are no guarantees in trading. Traders also don't need to be concerned about daily news and random price fluctuations. The method is based on three main principles:

- Locating the trend: Markets trend and consolidate, and this process repeats in cycles. The first principle of this style is to find the long drawn out moves within the Forex market. One way to identify a Forex trend is by studying 180 periods worth of Forex data. Identifying the swing highs and lows will be the next step. By referencing this price data on the current charts, you will be able to identify the market direction.

- Stay focused: This requires patience, and you will have to get rid of the urge to get into the market right away. You need to stay out and preserve your capital for a bigger opportunity.

- Less leverage and larger stop losses: Be aware of the large intraday swings in the market. Using larger stops, however, doesn't mean putting large amounts of capital at risk.

While there are plenty of trading strategy guides available for professional FX traders, the best Forex strategy for consistent profits can only be achieved through extensive practice. Here are some more Forex strategies revealed, that you can try:

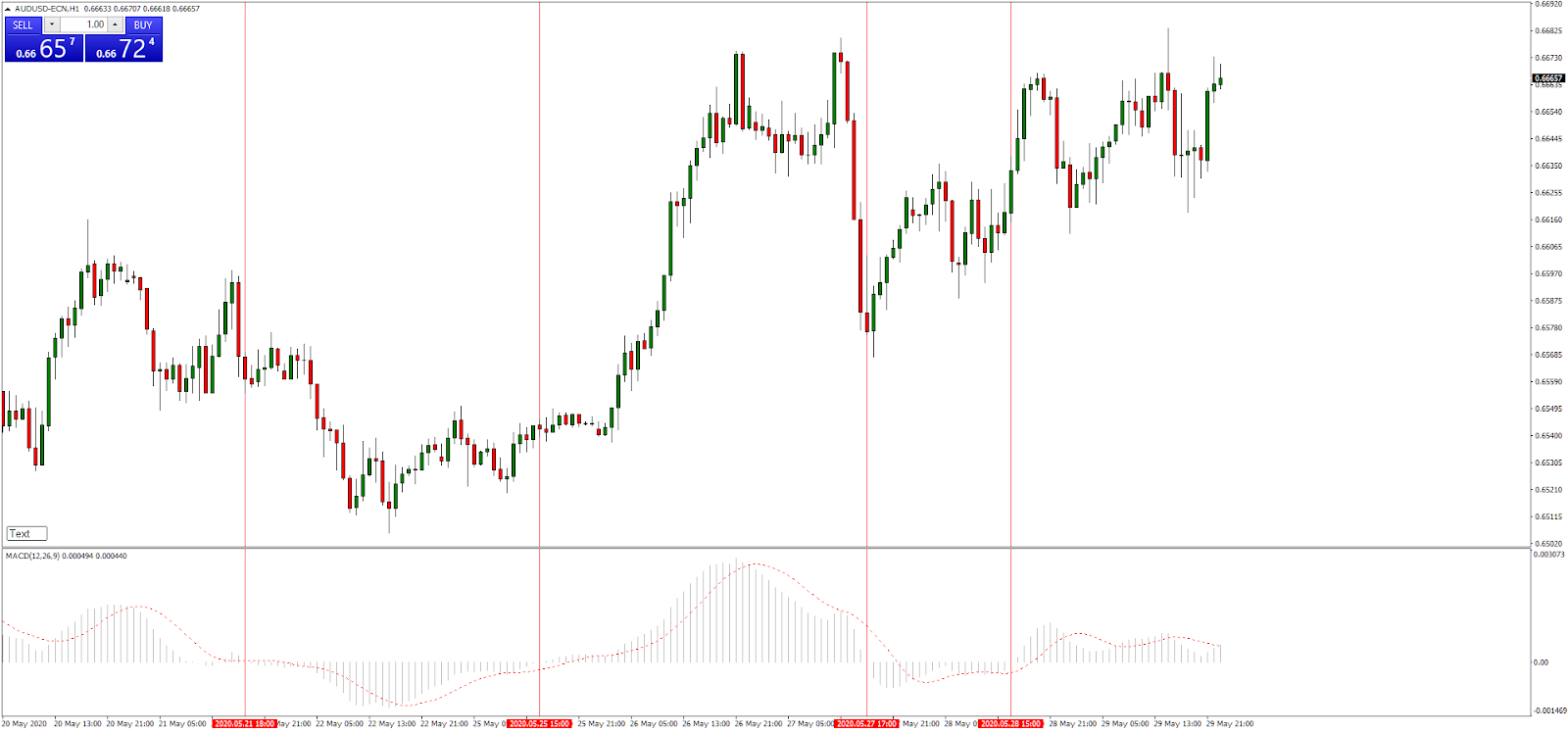

Forex 1-Hour Trading Strategy

You can take advantage of the 60-minute time frame in this strategy. The most suitable currency pairs to trade using this strategy are the EUR/USD, USD/JPY, GBP/USD, and the AUD/USD. In regards to Forex trading strategies resources used for this type of strategy, the MACD is the most suitable which is available on both MetaTrader 4 and MetaTrader 5.

Buy Trade Rules:

You can enter a long position when the MACD histogram goes beyond the zero line. The stop loss could be placed at a recent swing low.

Sell Trade Rules:

You can enter a short position when the MACD histogram goes below the zero line. The stop loss could be placed at a recent swing high.

Below is an hourly chart of the AUDUSD. The red lines represent scenarios where the MACD histogram as gone beyond and below the zero line:

Source:

Admiral Markets MetaTrader 4, AUDUSD, H1 chart (between 20 May 2020 to

31 May 2020). Accessed: 31 May 2020 at 11:45 am BST - Please note: Past

performance is not a reliable indicator of future results or future

performance.

Source:

Admiral Markets MetaTrader 4, AUDUSD, H1 chart (between 20 May 2020 to

31 May 2020). Accessed: 31 May 2020 at 11:45 am BST - Please note: Past

performance is not a reliable indicator of future results or future

performance.

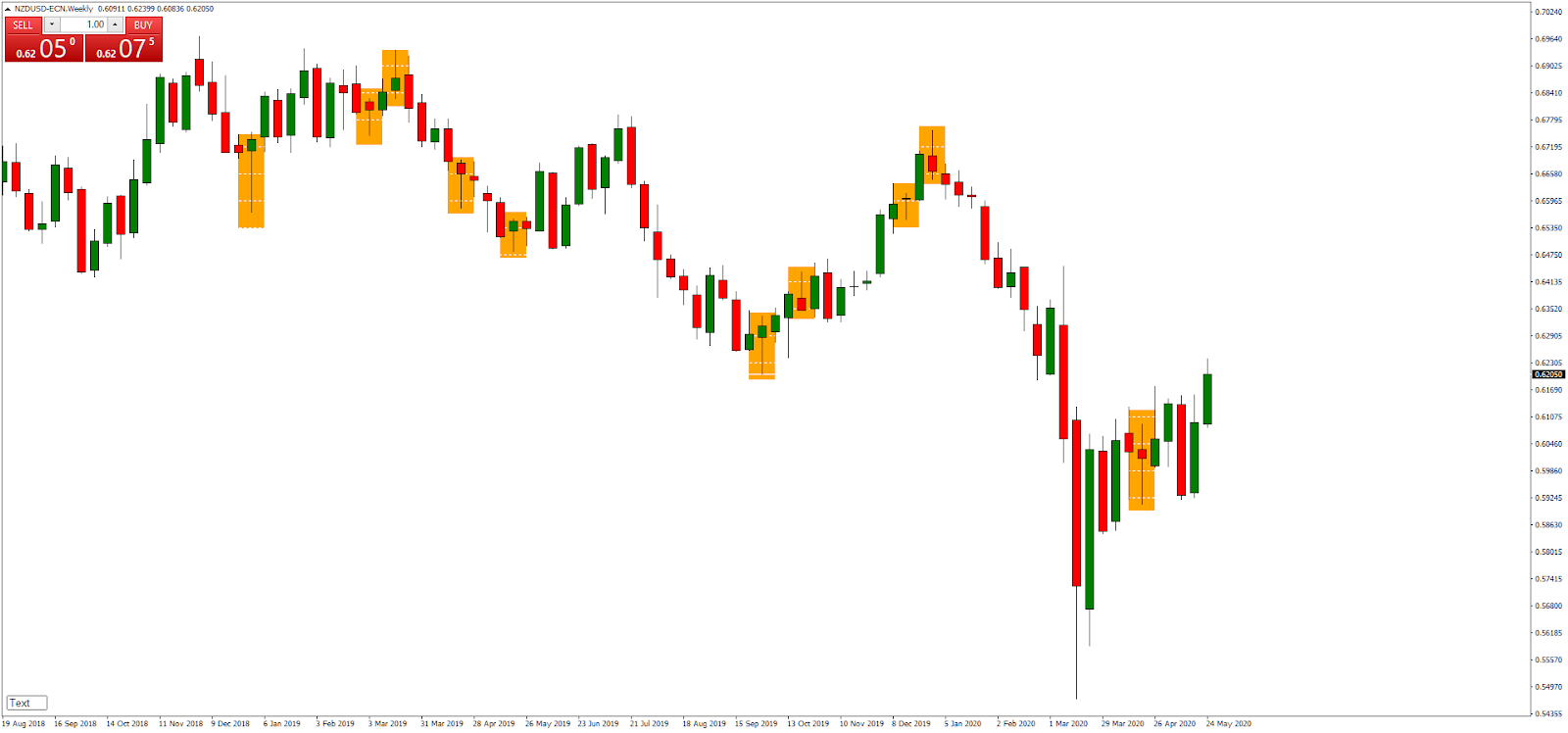

Forex Weekly Trading Strategy

While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. A weekly candlestick provides extensive market information. Weekly Forex trading strategies are based on lower position sizes and avoiding excessive risks.

For this strategy, traders can use the most commonly used price action trading patterns such as engulfing candles, haramis and hammers.

One of the most commonly used patterns in Forex trading is the hammer which looks like the image below:

The opposite of the hammer is the shooting star which looks like the image below:

The chart below shows the weekly price action of NZDUSD and examples of the patterns shown above.

Source:

Admiral Markets MetaTrader 4, NZDUSD, Weekly chart (between 19 August

2018 to 31 May 2020). Accessed: 31 May 2020 at 12:45 pm BST - Please

note: Past performance is not a reliable indicator of future results or

future performance.

Source:

Admiral Markets MetaTrader 4, NZDUSD, Weekly chart (between 19 August

2018 to 31 May 2020). Accessed: 31 May 2020 at 12:45 pm BST - Please

note: Past performance is not a reliable indicator of future results or

future performance.

The Role of Price Action Trading in Forex Strategies

To what extent fundamentals are used varies from trader to trader. At the same time, the best Forex strategy will invariably use price action. This is also known as technical analysis. When it comes to technical currency trading strategies, there are two main styles: trend following, and counter-trend trading. Both of these FX trading strategies try to profit by recognising and exploiting price patterns.

When it comes to price patterns, the most important concepts include ones such as support and resistance. Put simply, these terms represent the tendency of a market to bounce back from previous lows and highs.

- Support is the market's tendency to rise from a previously established low.

- Resistance is the market's tendency to fall from a previously established high.

This occurs because market participants tend to judge subsequent prices against recent highs and lows.

- What happens when the market approaches recent lows? Put simply, buyers will be attracted to what they regard as cheap.

- What happens when the market approaches recent highs? Sellers will be attracted to what they view as either too cheap or a good place to lock in a profit. Therefore, recent highs and lows are the yardsticks by which current prices are evaluated.

There is also a self-fulfilling aspect to support and resistance levels. This happens because market participants anticipate certain price action at these points and act accordingly. As a result, their actions can contribute to the market behaving as they had expected. However, it's worth noting these three things:

- Support and resistance levels do not present ironclad rules, they are simply a common consequence of the natural behaviour of market participants.

- Trend-following systems aim to profit from the times when support and resistance levels break down.

- Counter-trending styles of trading are the opposite of trend following—they aim to sell when there's a new high, and buy when there's a new low.

Comments

Post a Comment